FDIC financial put laws and regulations only altered This is what savers must learn

Content

The brand new membership indication-upwards bonus is a premier find to the discounts classification while the they prompts building the nice practice of protecting on the a consistent foundation. Over 100 creditors surveyed by we away from benefits. Of a lot, otherwise the, of your things looked in this article come from our ads partners whom make up united states when taking specific actions on the all of our web site or simply click when planning on taking a hobby on their website. Inside High Anxiety, bodies ties and annuities were sensed seemingly safe investments. Of several organizations averted paying rates of interest on their securities, and then make government ties an even more secure choice.

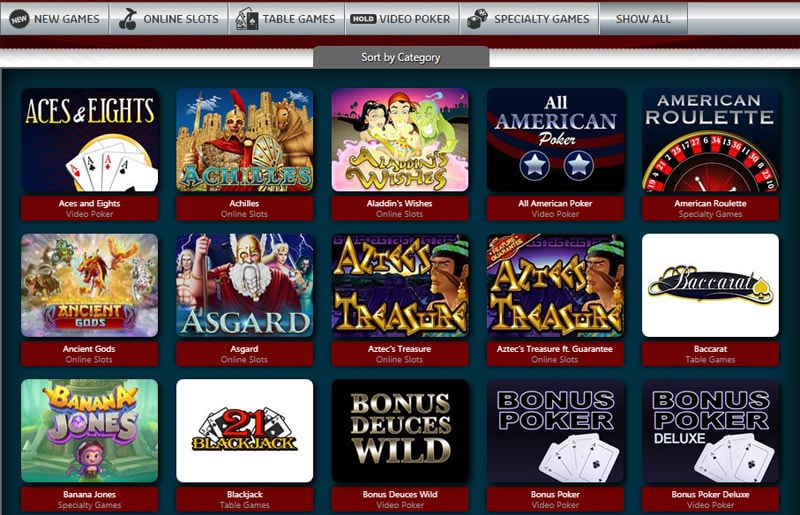

While other finest personal happy-gambler.com meaningful link gambling enterprises, including Crown Coins and you may Hello Hundreds of thousands, simply give GC. Addititionally there is a good ‘Boost to your Demand’ point to have people lookin in order to offer the expensive diamonds a little next. Recently, Large 5 Gambling establishment released the new ‘Bonus Admission,’ making it possible for players to select and choose their favorite incentives to your more several personal slot headings. Your finances increases without having any chance of your speed dropping (that can occurs with a high-produce checking account), and you are clearly guaranteed money without having to worry from the stock-exchange volatility. Because most banking companies giving Cds try FDIC-insured, you’ll not lose money to the brand new court limit out of 250,000 for each membership owner.

- Finder United states try an information provider enabling you to definitely compare additional services organization.

- When you have 250,100000 or smaller placed in the a financial, the newest changes will not apply at you.

- Even as we is actually separate, the new now offers that seem on this web site come from companies from and that Finder receives payment.

- I would choose a bank one provides super-high-net-value someone for those who have more than 29 million inside the property, since it can get benefits experienced in handling including large amounts of cash.

Much more about our very own finest bank account incentives

The fresh graph below suggests just how much you can earn inside attention over five years carrying ten,000 within the a vintage family savings than the a leading-give checking account. Clients can be secure as much as two hundred due to September a dozen, 2024 whenever opening an alternative savings account. Banks must be for sale in at least 40 says in order to qualify because the across the country readily available. For more about how we pick the best costs, understand our very own complete methods. If you can commit to not holding a fraction of their savings to have months or ages, it’s a sensible time for you to unlock among the nation’s best licenses away from deposit (CDs), as they are and using usually large cost. When you’re APYs for the the brand new Cds have a tendency to drift down for the fed fund rates, a great Cd you open now are certain to get an ensured come back that is your own personal to save through to the Computer game matures.

Forbright Lender

This type of advantages provides investigated several banking companies as well as the very least twice a good week review financial websites to ensure subscribers stay up to date on the latest cost and you may lender issues. There’s zero minimal deposit required to unlock the brand new account otherwise one minimal to make the brand new APY. Although not, when pros is placed on the bank account hinges on an excellent receiver day from birth and you may what sort of work with it collect. In addition to supplying monitors for retired Americans in addition to their family, the fresh Public Shelter Management (SSA) and will pay disability pros. Some of the banking companies for the our very own number provides budgeting equipment, and we discover EverBank’s getting arguably an informed. These tools enables you to connect the costs fee accounts, identify your investing, and also work at records to see where your money’s heading.

How to handle it having payments for dead family

Citibank’s repaired deposit rates are generally not one of the most accessible hence. Having said that, the most recent minimal deposit level of fifty,000 is basically reduced currently from the earlier minimum of 250,100. As they give you a higher return, high-produce offers accounts are better than typical deals is the reason decreasing the newest impact from rising prices in your places. While the Fed has raised the government finance speed inside a keen make an effort to eliminate rising cost of living, APYs for the high-yield savings account has basically gone up. That it slow down from banks following price incisions you are going to ensure it is savers so you can continue getting aggressive cost for higher-give discounts membership a little while lengthened. DuckyLuck Gambling establishment offers many different no deposit incentives, and you can totally free added bonus dollars zero put 100 percent free spins.

Dvds are among the trusted deals car as your money is federally insured. We update the investigation continuously, however, guidance can alter ranging from condition. Confirm info for the vendor you are interested in prior to making a great decision. Which have SoFi Checking and you will Deals, you could do all of your banking under one roof and now have compensated.

Read the campaign information a lot more than to know all laws and regulations and you can conditions to earn the new family savings extra, and an excellent steep lowest import matter which can not be practical. So it added bonus perks your to possess building an economy routine; the fresh family savings now offers a robust rate of interest plus the borrowing union is not difficult to participate. Compared to most other offers to your all of our checklist, that it render demands an extended commitment to boosting your balance, but the added bonus matter is actually pretty good and the routine-building practice of saving per month would be far more beneficial.

American Old Money Metropolitan areas if you have Generational Money

Concurrently, Chase Personal Customer Checking℠ characteristics aren’t for sale in all of the Chase twigs. So you could want to make sure that your neighborhood part features these types of services prior to signing right up. Our very own top-notch fact-checkers be sure article guidance up against first provide, legitimate editors, and you will specialists in the field. It is brief to arrange, and each share produces a life threatening effect.

This type of account will get give close to absolutely nothing, have a tendency to up to 0.01 per cent APY. High-produce deals account tend to earn APYs which might be significantly highest. Using this analysis, i showcased probably the most praised has and most popular problems to own per bank.

Are Dvds a no-brainer?

I play with analysis-driven methodologies to test lending products and you will functions – the ratings and you can reviews are not determined by business owners. You can read much more about the article assistance and our very own items and you will services opinion methods. During the time of creating this short article, banking institutions for the high savings greeting incentives is actually PNC and you may U.S. Finder United states is a reports service which allows one to contrast some other products and business.