Crisis Local rental Direction System

Articles

The brand new declaration need incorporate your own label and you will target and you may establish the brand new following. You might prove that you have a deeper connection to a couple of international countries (yet not over a few) for many who meet all the following conditions. You would not be an exempt private since the students within the 2024 if you have been excused because the an instructor, trainee, or college student for your element of over 5 diary ages if you do not meet both of the following requirements. See the definition of “immediate family,” earlier, below Overseas authorities-associated people.

Jacques https://gamblerzone.ca/frank-casino-review/ Dubois, that is a resident of one’s Us under Blog post cuatro of the Us-France tax pact, obtains French public protection pros. Less than Blog post 18(1) of your own pact, French social security benefits are not nonexempt by Us. Benefits conferred by the Article 18(1) is actually excepted regarding the protecting condition lower than Post 31(3) of your pact. Jacques isn’t needed to report the new French social defense professionals to your Function 1040 otherwise 1040-SR. Arthur Banking institutions try a nonresident alien who is solitary and you will a great resident of a different country that has an income tax pact which have the us.

Cellular put is only offered from the Wells Fargo Cellular application to the eligible mobiles. Availability can be impacted by your own cellular carrier’s publicity area. See Wells Fargo’s On the web Accessibility Agreement and your relevant business account fee disclosures to other terms, criteria, and you can constraints. Investment services are given thanks to Wells Fargo Advisors. Enroll in Wells Fargo Online out of your pc otherwise mobile device to have secure online entry to your own account. After you’ve signed up, you’ll discover an email verification, and you’ll anticipate to sign on and you can take control of your account.

Protection put attention laws

- Utilize the two testing discussed less than to choose whether something of U.S. resource income dropping in one of the about three classes over and you can received within the income tax seasons is actually effectively related to your own U.S. change or company.

- The sum will make sure one to Alzheimer’s problem gets the attention, look, and you may resources they will probably be worth.

- In the determining whether or not you have got maintained more critical connectivity to the overseas country than simply on the United states, the important points and things to be experienced were, however they are not limited to, next.

- Done so it schedule for those who noted the new Sure container at the items H on the Function It-203.

If you meet the requirements to help you prohibit days of presence since the a student, you must file a fully finished Function 8843 for the Internal revenue service. For those who qualify to ban days of visibility while the an instructor or trainee, you must document a fully accomplished Form 8843 on the Irs. For many who qualify to prohibit times of exposure on account of a great health condition, you ought to document a totally completed Function 8843 to your Irs.

Maryland Local rental Assistance Applications

Ted spent some time working from the U.S. workplace until December twenty-five, 2023, however, failed to get off the united states until January eleven, 2024. On the January 8, 2024, Ted obtained the past income for services performed regarding the Joined Says throughout the 2023. Each one of Ted’s income during the Ted’s stand the following is U.S. resource earnings. Make use of the a couple testing discussed below to determine if an item of You.S. supply earnings falling in one of the three classes a lot more than and you can obtained inside tax seasons try effectively associated with their You.S. trade otherwise business. If the testing imply that the item cash try effectively connected, you should include it with your almost every other effortlessly linked income. Should your items of income is not effectively linked, include it with some other money talked about within the 29% Income tax, after, inside part.

Tips ask for repairs from the property owner

- The new Commissioner otherwise Commissioner’s subcontract will send you a letter, led to the withholding representative, appearing the amount of the past commission out of compensation that is excused of withholding as well as the matter which may be paid off in order to your from the exclusion.

- Which amount do not surpass the quantity entered from the Federal number line.

- The law allows the newest Tax Company so you can costs a good $fifty percentage whenever a, currency acquisition, otherwise electronic fee is actually returned by a lender for nonpayment.

There is absolutely no 29% tax to the focus-relevant dividends out of provide inside the All of us that you will get of a mutual money or other controlled funding company (RIC). The newest mutual money usually specify on paper and this dividends is desire-associated dividends. A duty who does if not meet the requirements to settle entered setting isn’t said to be inside entered mode as of a particular day if it is going to be converted any moment later on to your an obligation that isn’t within the entered setting. More resources for whether personal debt are believed to be in inserted mode, see the discussion of profile interest under Withholding for the Specific Income in the Club. Interest to your debt out of your state otherwise governmental subdivision, the brand new Area from Columbia, otherwise an excellent You.S. region is generally perhaps not found in earnings.

To amend from independent tax returns to a mutual taxation return, pursue Mode 540 instructions to accomplish only one revised income tax go back. Both you and your partner/RDP must indication the newest revised combined tax return. You cannot subtract the brand new number you have to pay to possess regional advantages one apply at possessions within the a restricted city (construction out of streets, pavements, otherwise drinking water and you will sewer systems). You must check your a house goverment tax bill to decide or no nondeductible itemized fees are included in their bill. You ought to in addition to attach a copy away from government Setting 1310, Report of People Saying Reimburse Due a dead Taxpayer, and you will a duplicate of one’s demise certification once you document a taxation go back and you may claim a refund owed. Build volunteer contributions of $1 or higher entirely money numbers to your fund indexed below.

Line 116 and you may Line 117 – Direct Deposit away from Refund

When you are both a good nonresident alien and you will a resident alien in identical tax season, come across section six for a dialogue away from twin-condition aliens. You’re an enthusiastic LTR if perhaps you were a lawful permanent resident of your own You in the at the very least 8 of the past 15 taxation decades finish to the season your house comes to an end. Inside the deciding for many who meet the 8-12 months demands, do not amount any year that you will be managed because the an excellent resident out of a foreign country lower than a taxation pact and perform perhaps not waive pact professionals. You could make this choice simply for real estate income one is not or even effortlessly related to their U.S. exchange otherwise team. Tax from the a good 30% (or straight down pact) rates relates to certain pieces of money otherwise gains out of You.S. supply but only when the items are not effortlessly related to your own U.S. change otherwise organization.

Costs

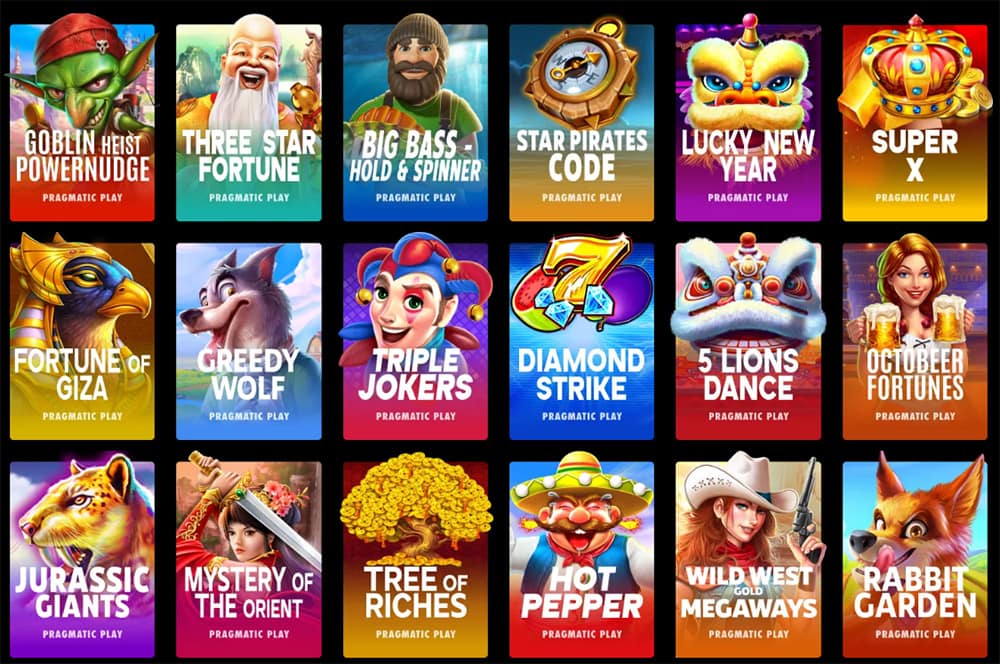

Mainly because are some of the extremely starred game up to, it’s appear to the case you to participants might have been playing them to begin with. That is a majority of why they’ve been popular, however, considering the fact that you could potentially winnings real money winnings from all of these bonuses, you can understand why players like her or him a whole lot during the $5 minimal put gambling enterprise sites. Something that 888 Gambling enterprise is known for are reduced minimal dumps to their invited incentive. Including the capability to get a 100 % suits to own merely five dollars. Not simply is it amazing really worth, however, they are also one of the Top 10 minimum put gambling enterprises available in the. So it $5 put gambling establishment has been in existence for a long period, has a top-tier online game possibilities and possess application partnerships with a lot of of your own better developers around the world.

At the same time, the fresh volatility about label is leaner than you see with most 100 percent free revolves now offers at the casinos that have $5 min put. Therefore, you can lender on the more frequent but moderate gains rather than a good “larger win otherwise tits” strategy during the Frost Casino. Our philosophy in the $5 gambling enterprise incentives is you must always aim for purchased doing something you were going to be performing anyway. In this way, delivering covered to experience your chosen games can be helpful whether or not you are making a minimal $5 minute put.

Taxpayer Direction In the All of us

This is for example difficult if previous information is unfinished otherwise when the indeed there’s too little quality concerning the interest rates that have been applied by former property owner. The safety deposit is intended to protection fixes and you will clean up can cost you. For many who wear’t spend the lease, obviously, they will ensure that is stays to pay for their rent.

Probably one of the most extremely important try get together a protection put and you will the first day’s rent. Although this tunes quick, per county provides other legislation based on how to get, store, and go back shelter places. So you can make clear conformity and relieve costs, of a lot landlords play with no-percentage examining membership to hold such finance securely and you can individually of private cash. You are a dual-reputation alien while you are both a resident alien and you can a great nonresident alien in identical year. To own information on deciding the fresh You.S. tax liability for a dual-status taxation seasons, discover part 6.